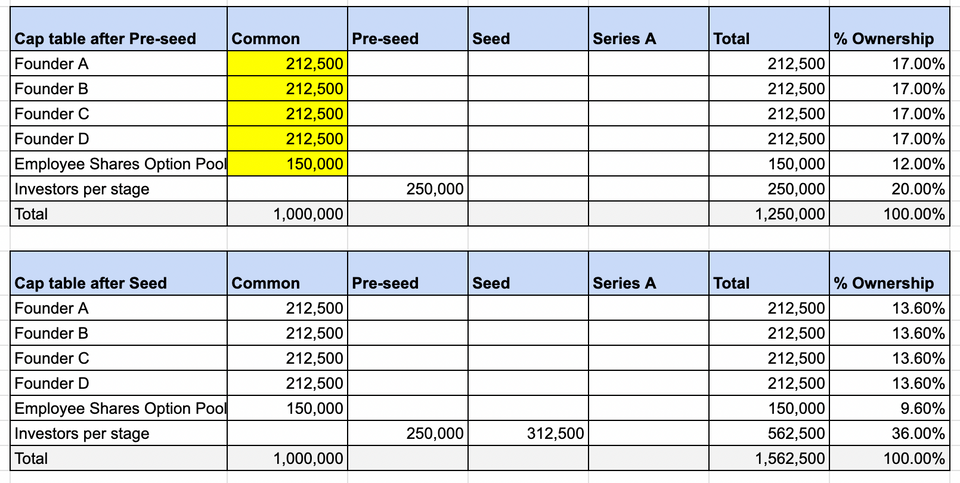

Cap Table Modeling

You’re excited about the idea, and you have a team in place. You’re meeting investors, and there’s enough interest that you think you’re going to be able to raise a round of money. Once you embark on the road to raising money from investors, you are running a company with outside capital, not with revenue from products. That’s all fine because you can move much quicker than organically spending many years building the business to become a company that moves quickly.

One topic that often doesn’t get talked about is what the VC path does to your ownership and cap table. VCs know that the founder’s motivation will be infected so much from their ownership in the company. When you own 50% of the company on day-1, versus owning 5% of the company after several rounds of investors coming in, the motivation can start to deteriorate.

It’s time to start thinking about your cap table.

Cap Table Modeling

I’ve created a template for cap table modeling. I wish I would have had something similar when I started Next Games and that I would have methodically followed the dilution per fundraising round.

With this template, you can model out how future financing rounds will affect your cap table. There is a helpful Youtube video here, where I walk through all the aspects of the modeling template.

Get the template

You can get the template in Excel format. We are currently in version 1.1, with the latest version containing some recent bug fixes. As new releases of the template become available, we will be updating this page with the details on the updates.

Have fun!

Did you enjoy this article?

Here are some more articles to take a look at.